Offer built-in

ZERO covers leasing contracts when

employees leave. Deliver a worry-free

leasing experience to your corporate clients

with no financial risk.

Standard, uncovered leasing is highly unattractive to employers.

ZERO protects your leasing contracts,

by adding a safety net for employers.

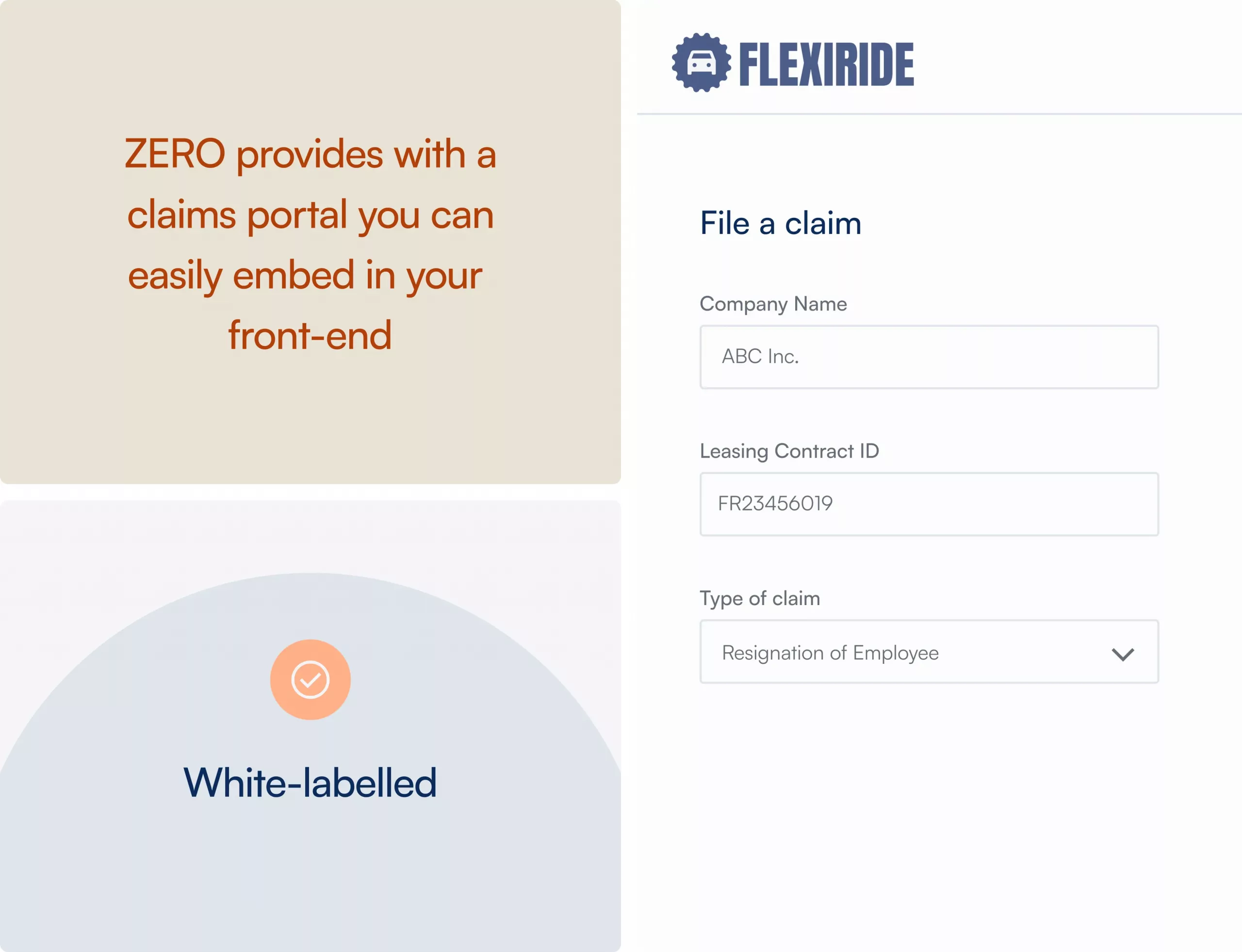

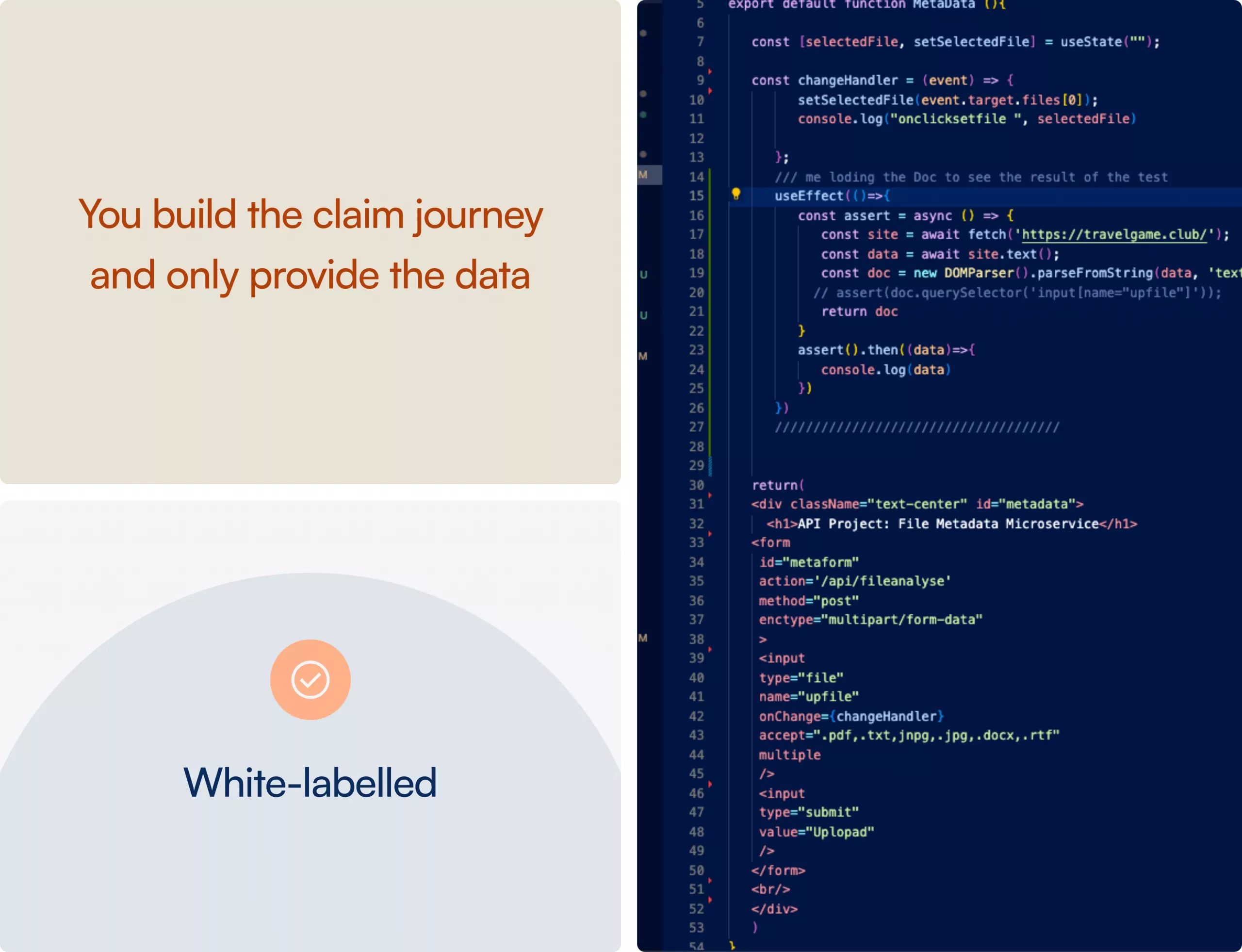

White-Labeled Insurance Product

Get a fully built insurance product, ready to sell.

ZERO delivers a turnkey payment protection product with all required contracts and compliance. Simply add it to your service, and it’s ready to go.

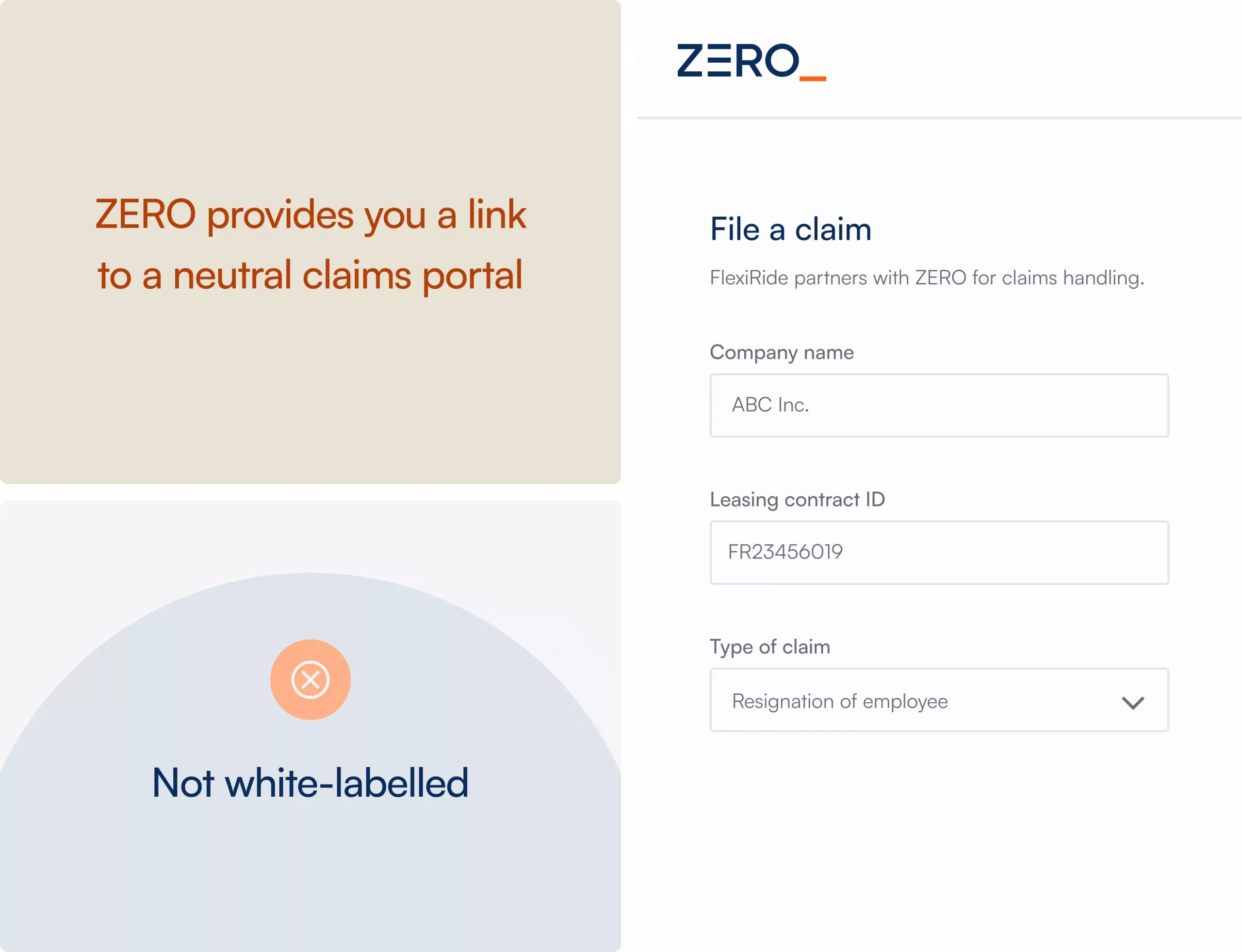

Full Service claims Management

When your customers file a claim, we handle it all.

Support your customers in the midst of their financial hardship — they can file a claim straight from your platform. We review and approve within 72 hours, then send you the money.

Flexible Packaging & UX

Make leasing protection a USP

of your offering.

It’s simple to integrate ZERO and keep your user experience smooth and simple with our adaptable API.

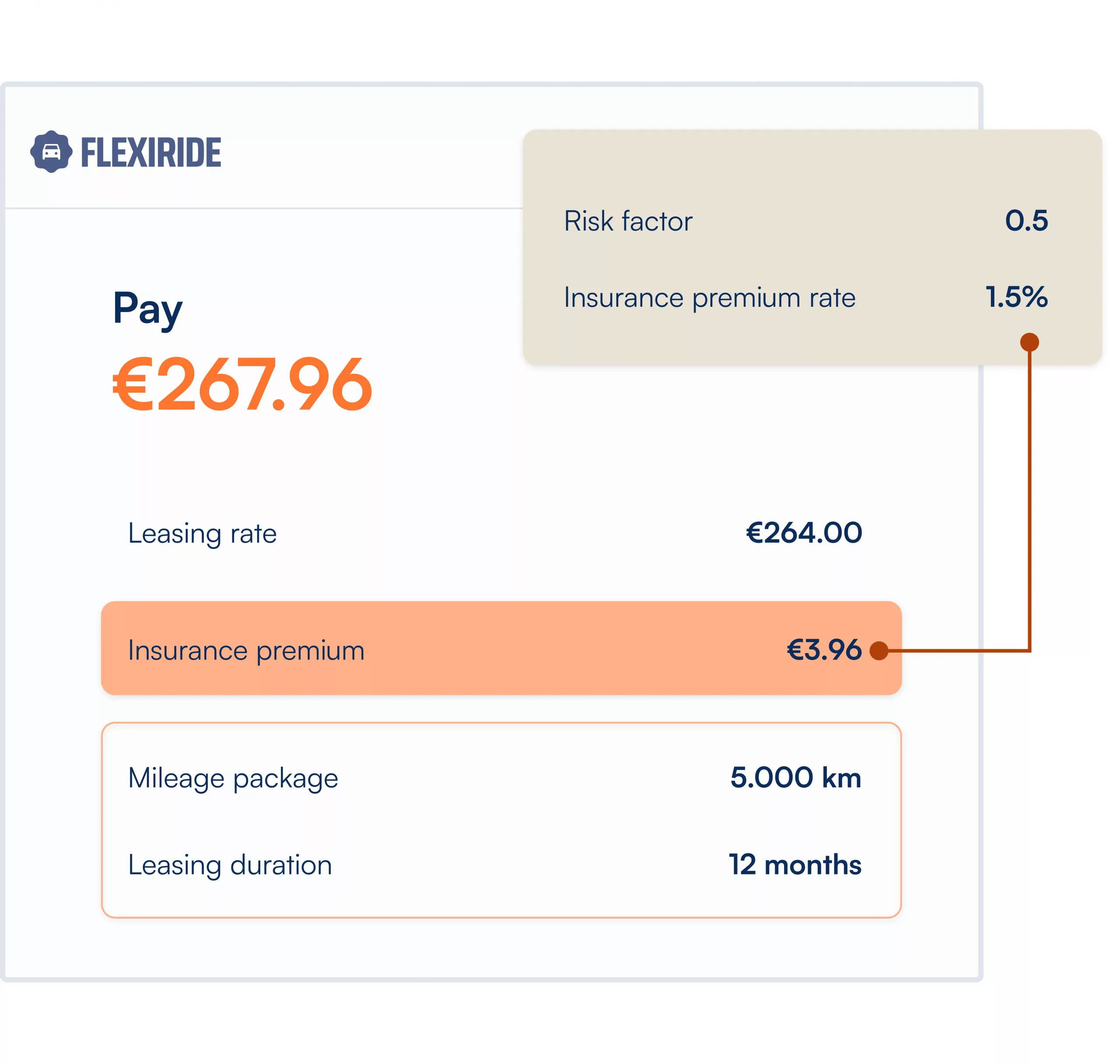

Transparent pricing

Premiums starting at 2€… without health checks.

Unlike other policies, ZERO skips bumpy underwriting processes and is available to everyone.

ZERO’s leasing protection has quickly become a real asset to our offering. It gives our customers added security and makes our sales conversations much smoother. Since adding it, we’ve seen an increase in conversion rates and stronger customer loyalty. The collaboration with the ZERO team is efficient, professional, and refreshingly straightforward.

Sebastian Becker

Vilocar

ZERO isn’t just for car lease companies

Banks providing loans

Help your customers manage loan payments if sickness or job loss disrupts their finances.

Landlords renting properties

Help your tenants protect their rent payments, so they can remain in their homes.

Car subscription providers

Keep your revenue consistent and your customers

on the road.

Got questions? Play it safe with ZERO

Our leasing protection covers corporate car leases when employees leave the company (e.g. through termination, resignation, or death) or become incapable for for for more than 42 days (e.g. through long-term sickness). As the employer is the official leaseholder, they remain liable for those leasing contracts even when the respective employee is no longer part of their workforce. ZERO’s leasing protection allows the employer to return the leased car and we cover the financial loss of the leasing provider caused by those premature leasing returns.

ZERO’s leasing protection allows the employer to return the leased car with the employee leave date. ZERO covers the financial loss of the leasing provider caused by those premature leasing returns.

Once the salary payment is paused (in Germany, this happens after 42 days of continuous sickness), ZERO covers the monthly leasing rates for up to 12 months. This allows the employee to keep the car even in bumpy times.

ZERO covers all types of car leasing contracts where the employer is the official leaseholder (in German: “Firmenwagen durch Entgeltumwandlung”).

Our leasing protection is designed to be a fixed feature or benefit of the leasing contract.

ZERO’s claim journey is usually embedded into our partner’s customer portal. Your customers simply log into their account, open the claim center, and upload all required documents and information. This varies by the different types of a claim. Example: In the event of an employee resigning, the employer just uploads the letter of resignation.

We believe strong customer relationships are built on trust. That’s why the leasing provider remains the first point of contact. Of course, whenever insurance expertise is needed, we’re right behind you to support.